District Adopted Budget

State law requires the Board of Education to adopt and appropriate a budget for all District funds each year. The Budget serves three primary purposes:

- It is a planning document for the Board of Education, the Superintendent, and District staff for financing educational programs.

- It enables the Board of Education to determine the dollars necessary for funding various programs and to make appropriations consistent with state laws and District policies.

- It is an instrument of control in spending practices. It indicates the current year’s relative position of expenditures to estimated available dollars, and identifies the expenditures for preceding years.

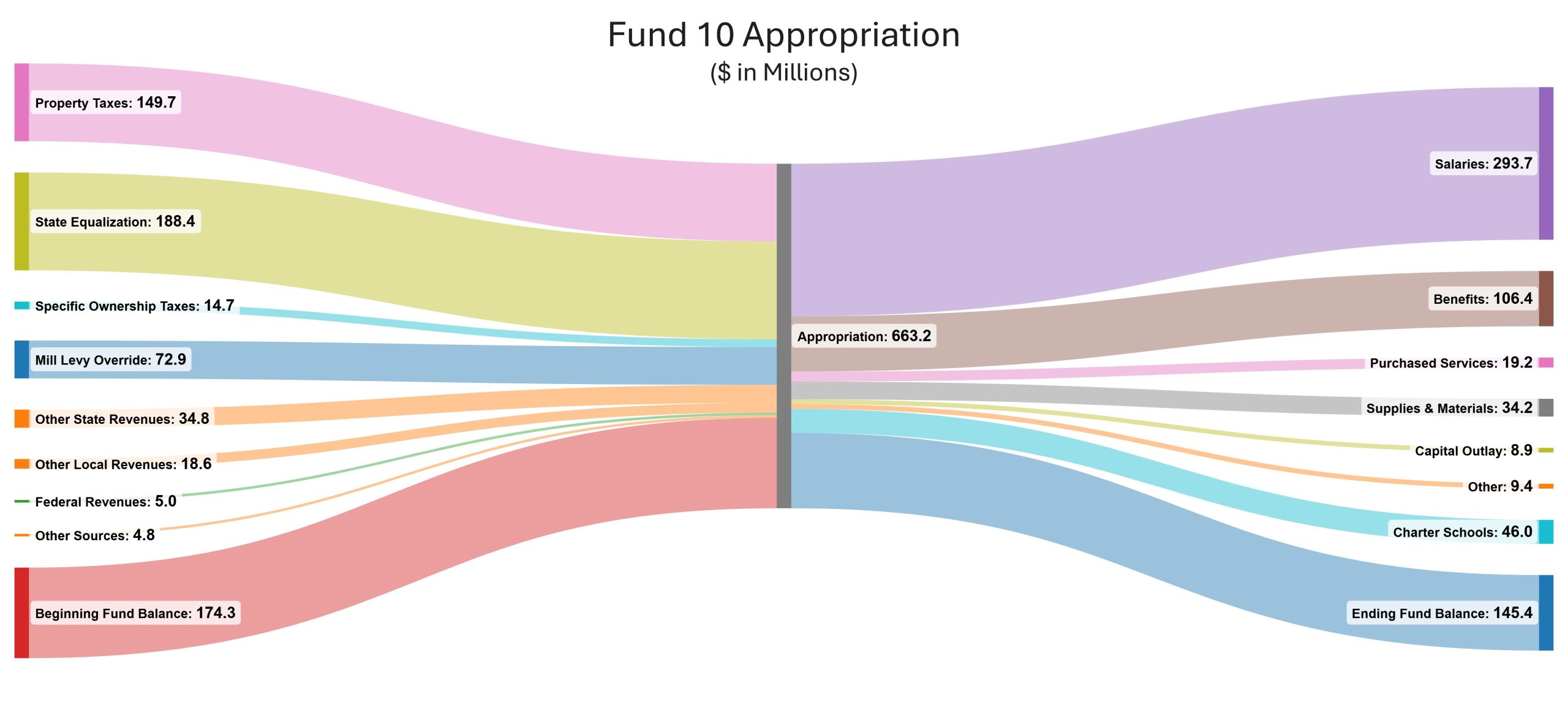

General Fund

The St. Vrain Valley School District’s annual General Fund operating budget is used to teach students, to purchase textbooks and other classroom supplies, for student transportation, and to maintain school buildings and grounds. It funds special education programs, school-based focus programs, charter schools and programs for students for whom English is a second language. It is used to pay salaries for teachers and other staff, provide health and retirement benefits, and support additional ongoing professional training.

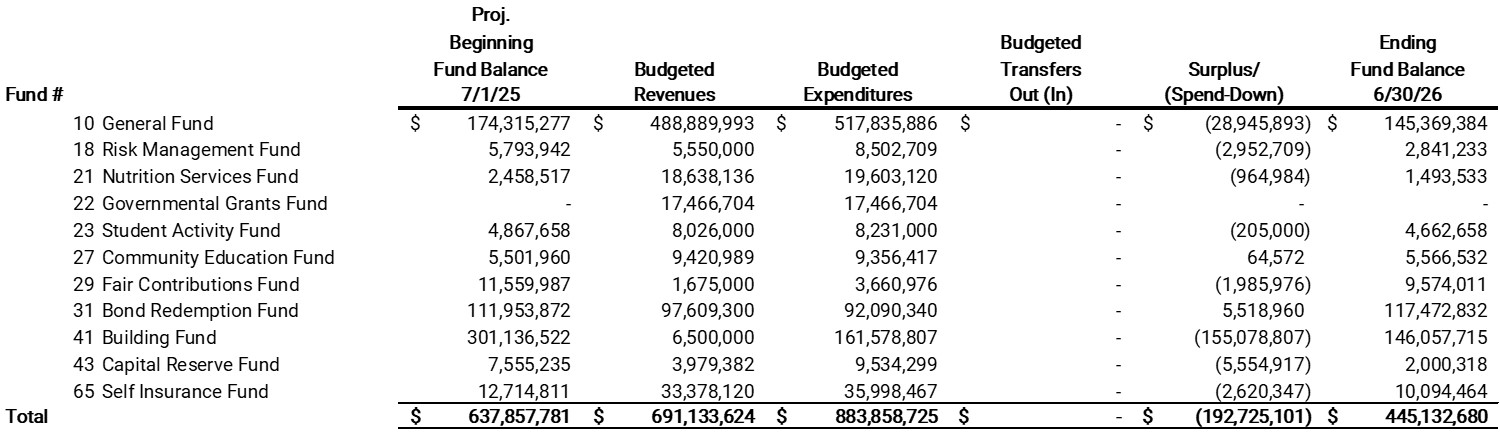

ST. VRAIN VALLEY SCHOOL DISTRICT RE-1J

PROPOSED BUDGET SUMMARY BY FUND

FISCAL YEAR ENDING JUNE 30, 2026

Other Funds

In addition to the FY26 General Fund expenditure budget of $517.8 million, the District manages 10 other funds. Separate from the General Fund, expenditure budgets for all other funds total approximately $366.0 million. A summary and description of these funds are listed below.

The Risk Management and Capital Reserve Funds contain a per-student allocation transferred from total state funding to purchase land, construct or improve facilities, and to provide liability insurance coverage.

The Nutrition Services Fund provides resources for student meals. St. Vrain Valley schools serves tens of thousands of lunches each day in addition to providing a breakfast program, summer lunch program, and snack program. This fund receives income from cash sales and from the Federal School Lunch and Breakfast Program.

The Grants Fund is funded primarily from federal sources that have been awarded to the District for specific programs such as Title I (additional support for students in poverty), hearing impaired, special education, English as a Second Language, and other special projects and grants.

The Student Activity Fund contains funds from student fundraisers, donations and gate receipts that support school-sponsored interscholastic and intrascholastic athletic, performing arts and other student-related events.

The Community Education Fund provides such activities as Community Schools programming, enrichment activities, and other community activities. This fund is self-supporting as a result of participant fees and grants from local partners.

The Fair Contributions Fund is used to track funds collected for acquisition, development or expansion of public school sites based on the impacts created by residential subdivisions.

The Bond Redemption Fund is made up of dedicated local property tax revenues, held in trust by UMB Bank, that are used to pay the principal and interest commitments resulting from voter-approved capital school bond sales.

The Building Fund is used to budget and account for the proceeds of bond sales and expenditures for capital outlay for land, buildings, improvements of grounds, construction of buildings, additions or remodeling of buildings, or the initial purchase and replacement of certain equipment

The Self Insurance Fund is used to account for the District’s self-funded medical and dental insurance plans.

The Colorado Preschool Fund was used to track state-funded CPP program funds for qualifying preschool students. With the implementation of Universal Preschool (UPK) in Colorado starting in the 2023-2024 school year the CPP Fund will not be utilized starting with the 2024-2025 fiscal year. UPK revenues are categorized as state funded revenue within the General Fund. The fund remains in the budget document for historical purposes only.

Budget Report Archive

A listing of adopted budgets and subsequent amended budgets are made available to the public.

2026

Adopted budget for the fiscal year ending June 30, 2026

2025

Adopted budget for the fiscal year ending June 30, 2025

Amended budget for the fiscal year ending June 30, 2025

2024

Adopted budget for the fiscal year ending June 30, 2024

Amended budget for the fiscal year ending June 30, 2024

2023

Adopted budget for the fiscal year ending June 30, 2023

Amended budget for the fiscal year ending June 30, 2023

2022

Adopted budget for the fiscal year ending June 30, 2022

Amended budget for the fiscal year ending June 30, 2022

2021

Adopted budget for the fiscal year ending June 30, 2021

Amended budget for the fiscal year ending June 30, 2021

2020

Adopted budget for the fiscal year ending June 30, 2020

Amended budget for the fiscal year ending June 30, 2020

2019

Adopted budget for the fiscal year ending June 30, 2019

Amended budget for the fiscal year ending June 30, 2019

2018

Adopted budget for the fiscal year ending June 30, 2018

Amended budget for the fiscal year ending June 30, 2018

2nd Amended budget for the fiscal year ending June 30, 2018

2017

Adopted budget for the fiscal year ending June 30, 2017

Amended budget for the fiscal year ending June 30, 2017

2nd Amended budget for the fiscal year ending June 30, 2017

2016

Adopted budget for the fiscal year ending June 30, 2016

Amended budget for the fiscal year ending June 30, 2016

2nd Amended budget for the fiscal year ending June 30, 2016

2015

Adopted for the fiscal year ending June 30, 2015

Amended for the fiscal year ending June 30, 2015

2nd Amended for the fiscal year ending June 30, 2015

2014

Adopted for the fiscal year ending June 30, 2014

Amended for the fiscal year ending June 30, 2014

2nd Amended for the fiscal year ending June 30, 2014

2013

Adopted for the fiscal year ending June 30, 2013

Amended for the fiscal year ending June 30, 2013

2nd Amended for fiscal ending year June 30, 2013

2012

Adopted for the fiscal year ending June 30, 2012

Amended for the fiscal year ending June 30, 2012

2011

Adopted for the fiscal year ending June 30, 2011

Amended for the fiscal year ending June 30, 2011

2nd Amended for the fiscal year ending June 30, 2011

2010

Adopted for the fiscal year ending June 30, 2010

Amended for the fiscal year ending June 30, 2010

2nd Amended for fiscal ending year June 30, 2010

2009

Adopted for the fiscal year ending June 30, 2009

Amended for the fiscal year ending June 30, 2009

2008

Adopted for the fiscal year ending June 30, 2008

Amended for fiscal year ending June 30, 2008

2nd Amended for fiscal ending year June 30, 2008

2007

Adopted for the fiscal year ending June 30, 2007

Amended for fiscal year ending June 30, 2007

2006

Adopted for fiscal year ending June 30, 2006

Amended for fiscal year ending June 30, 2006

2nd Amended for fiscal ending year June 30, 2006

2005

Adopted for fiscal year ending June 30, 2005

Amended for fiscal year ending June 30, 2005

Appropriation Resolution

2004